COVID-19 Impact on Workers Compensation Industry

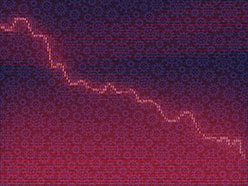

According to a survey put out by health industry guru and strategist Joe Paduda, the workers compensation system could see a 20 percent decrease in new injury claims this year due to the coronavirus pandemic.

In late May, Paduda's consultancy firm Health Strategy Associates asked 35 workers compensation professionals representing large state funds and insurers, third-party administrators, and large self-insured and self-administered employers about their expectations of workers compensation costs amid the pandemic.

"Although respondents are somewhat concerned about presumption laws, the major impact has not come from COVID-19 claims and their costs," said Paduda. (Presumption laws have been passed in many states stipulating that if first line responders, such as police, fire, EMT and other professionals contract COVID-19, their condition is presumed to be work-related.)

Service providers who responded to the survey said their new workers comp claims dropped by as much as 50 percent, with occupational medicine clinics, transportation companies, imaging, physical therapy, field case management and independent medical providers taking the biggest hit.

According to the survey, payers expect to see premium reductions as a result of widespread business closures. But survey respondents also expect to see extended disability claims for non-COVID-19 due to delays in procedures, treatment and the adjudication of cases.

Most leaders in the workers comp industry do not expect to see a significant number of COVID-19 claims, according to the survey. Respondents reported a total of 33,000 COVID-19 claims, with a little more than 20 percent of them accepted. Early figures on such claims have shown them to be generally inexpensive, according to the report. One survey respondent said that 96 percent of the claims it received cost less than $3,500.

According to the survey, the pandemic has led to explosive growth in telemedicine and respondents believe the use of telehealth and telephonic case management will have a positive impact on the workers comp industry.

NCCI Says Workers Comp Industry "Well Positioned" for COVID-19

Shortly before release of the Health Strategy Associates survey in June, the National Council on Compensation Insurance (NCCI), the leading ratemaking organization for the workers compensation industry, stated at its Annual Issues Symposium in Boca Raton, Fla., that years of profitable underwriting and healthy reserves in 2019 will help the workers compensation industry weather coronavirus-related claims and lower premium in the coming months.

"The two themes you will hear are unprecedented financial strength and consistent performance," said Donna Glenn, NCCI’s chief actuary, in a "state of the line" presentation that addressed where the industry stands as it faces unanswered questions regarding the pandemic's effect on financial results.

"The system is well-positioned to face COVID-19 stress," she said.

The workers comp sector has reported profitable results in recent years. In 2019, the industry reported a combined ratio for private carriers of 85 percent, making it the sixth consecutive year that the workers comp line of business has posted an underwriting gain. Last year also marked the third consecutive year of a combined ratio under 90 percent. The two most recent years, including the 83 percent combined ratio in 2018, showed the lowest workers comp combined ratio since the 1930s, according to the presentation.

Going forward, however, the industry will be deeply affected by COVID-19 claims, said Bill Donnell, NCCI president and CEO.

"Every aspect of workers compensation will be affected" by the pandemic, including claim activity stemming from infections, the extent of which is still unknown, and claims in states adopting changes to workers comp laws that would provide presumption coverage for frontline workers outside of health care who are usually not covered for viral infections.

Ms. Glenn highlighted that as of year-end 2019, the overall reserve position for private insurers stood at a $10 billion redundancy, doubled from $5 billion at year-end 2018. This means premium rates continued to outpace loss costs.

Meanwhile, average lost-time claim frequency across all 38 states that work with NCCI declined by 4 percent in 2019, on a preliminary basis, and preliminary 2019 accident year data showed average indemnity claim severity increased by 4 percent compared to 2018. Medical lost-time claim severity increased by 3 percent.

Looking ahead, Ms. Glenn said one of the "biggest unknowns" will be the length of shutdowns. In addition, different industries will post different results. The decline in hospitality, manufacturing and distribution, for example, could be offset by increased demand for health care, groceries and home delivery of goods. In the "middle," many industries have increased telecommuting, which has led to fewer layoffs in some fields.

Claim activity will also vary, Ms. Glenn said. Some employees may delay care or not report claims, and some existing claimants could see their return to work and recovery hindered by fewer jobs and doctor check-ups. "Hard data" on the overall effect of the pandemic will be "extremely limited in the short run," she said.

COVID-19 Impact on Workers Compensation Industry

How Does Self-Insured Workers Compensation Work?

Excess Workers Compensation Comes in Two Basic Formats.

The information presented and conclusions within are based upon our best judgment and analysis. It is not guaranteed information and does not necessarily reflect all available data. Web addresses are current at time of publication but subject to change. SmartsPro Marketing and The Insurance 411 do not engage in the solicitation, sale or management of securities or investments, nor does it make any recommendations on securities or investments. This material may not be quoted or reproduced in any form without publisher’s permission. All rights reserved. ©2020 Smarts Publishing. Tel. 877-762-7877. httpss://smartspublishing.com